The Single Strategy To Use For Transaction Advisory Services

Table of ContentsAn Unbiased View of Transaction Advisory ServicesAn Unbiased View of Transaction Advisory ServicesThe Ultimate Guide To Transaction Advisory Services8 Simple Techniques For Transaction Advisory ServicesExamine This Report about Transaction Advisory Services

This action makes sure the organization looks its ideal to potential buyers. Obtaining the service's worth right is vital for a successful sale.Transaction experts step in to assist by getting all the required info arranged, answering inquiries from purchasers, and organizing brows through to business's place. This constructs depend on with buyers and maintains the sale moving along. Obtaining the best terms is key. Purchase advisors utilize their expertise to aid local business owner take care of hard settlements, meet purchaser assumptions, and structure offers that match the proprietor's objectives.

Fulfilling legal regulations is vital in any kind of organization sale. Deal advising solutions deal with lawful specialists to create and assess agreements, arrangements, and various other lawful documents. This minimizes threats and ensures the sale follows the law. The role of deal experts expands past the sale. They assist local business owner in intending for their following actions, whether it's retirement, starting a new endeavor, or handling their newly found wide range.

Deal consultants bring a riches of experience and knowledge, guaranteeing that every aspect of the sale is dealt with professionally. Via critical prep work, evaluation, and arrangement, TAS helps business proprietors attain the greatest possible list price. By ensuring lawful and governing compliance and managing due persistance together with various other offer staff member, deal advisors decrease prospective threats and obligations.

Transaction Advisory Services Fundamentals Explained

By comparison, Huge 4 TS groups: Deal with (e.g., when a potential customer is performing due persistance, or when a deal is shutting and the buyer requires to integrate the company and re-value the vendor's Balance Sheet). Are with fees that are not linked to the deal closing successfully. Gain charges per involvement somewhere in the, which is much less than what financial investment financial institutions make even on "little deals" (but the collection chance is additionally much greater).

The meeting inquiries are extremely comparable to investment financial interview inquiries, but they'll concentrate much more on audit and assessment and less on topics like LBO modeling. For example, anticipate questions regarding what the Modification in Capital ways, EBIT vs. EBITDA vs. Take-home pay, and "accounting professional only" subjects like trial balances and just how to walk with occasions making use of debits and credit histories rather than economic declaration changes.

Little Known Questions About Transaction Advisory Services.

that show just how both metrics have actually altered based on products, channels, and clients. to evaluate the precision of administration's previous forecasts., consisting of aging, inventory by item, ordinary degrees, and stipulations. to establish whether they're entirely imaginary or somewhat believable. Professionals in the TS/ FDD teams might likewise speak with administration about Continued everything over, and they'll compose a comprehensive report with their searchings for at the end of the procedure.

The hierarchy in Purchase Solutions varies a little bit from the ones in investment financial and personal equity professions, and the basic form resembles this: The entry-level duty, where you do a great deal of data and economic evaluation (2 years for a promo from here). The next level up; similar work, however you obtain the even more intriguing bits (3 years for a promotion).

Specifically, it's difficult to obtain promoted past the Supervisor level since couple of people leave the task at that phase, and you need to begin revealing evidence of your capacity to generate profits to development. Allow's start with the hours and way of life since those are much easier to define:. There are occasional late evenings and weekend break work, however absolutely nothing like the frantic nature of financial investment banking.

There are cost-of-living adjustments, so expect reduced payment if you're in a less costly area outside significant economic (Transaction Advisory Services). For all placements other than Companion, the base pay comprises the bulk of the overall payment; the year-end bonus could be a max of 30% of your base pay. Often, the most effective way to increase your Bonuses profits is to switch over to a different firm and bargain for a higher wage and benefit

Not known Factual Statements About Transaction Advisory Services

At this phase, you must just stay and make a run for a Partner-level duty. If you want to leave, possibly move to a customer and perform their assessments and due persistance in-house.

The primary trouble is that since: You generally need to sign up with another Huge 4 team, such as audit, and work there for a few years and after that move into TS, job there for a few years and afterwards move into IB. And there's still no warranty of winning this IB role since it relies on your region, customers, and the working with market at the time.

Longer-term, there is also some danger of and due to the fact that evaluating a company's historic economic info is not exactly rocket scientific research. Yes, human beings will certainly constantly need to be included, however with advanced modern technology, reduced head counts might potentially support customer interactions. That claimed, the Deal Services team beats audit in regards to pay, work, and exit opportunities.

If you liked this short article, you could be thinking about reading.

The Definitive Guide for Transaction Advisory Services

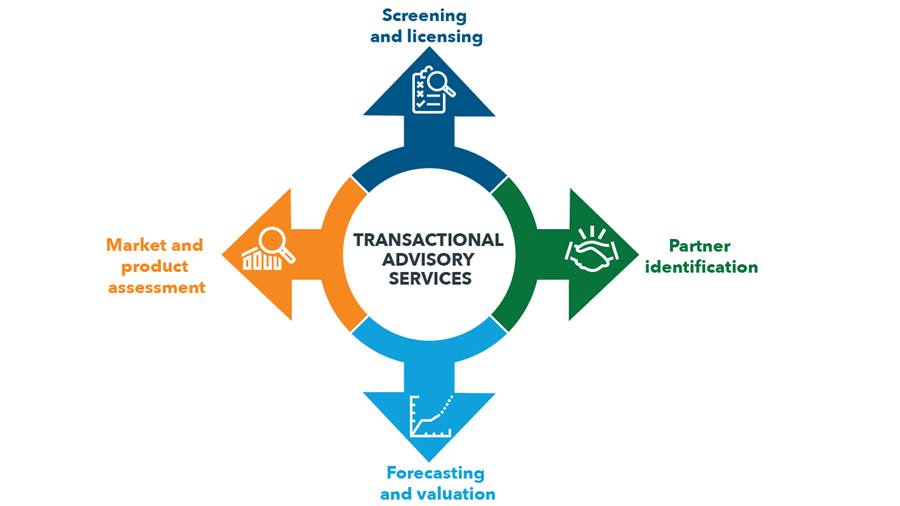

Develop advanced financial frameworks that aid in identifying the actual market worth of a company. Offer consultatory work in relation to business valuation to assist in bargaining and prices structures. Clarify one of the most ideal form of the offer and the kind of factor to consider to utilize (money, stock, gain out, and others).

Develop activity strategies for danger and exposure that have been identified. Perform integration preparation to figure out the process, system, and business changes that may be required after the bargain. Make mathematical quotes of assimilation costs and advantages to examine the economic reasoning of combination. Set guidelines for incorporating divisions, technologies, and business processes.

Evaluate the prospective consumer base, sector verticals, and sales cycle. The functional due diligence offers important insights their website right into the functioning of the firm to be acquired concerning risk evaluation and value production.